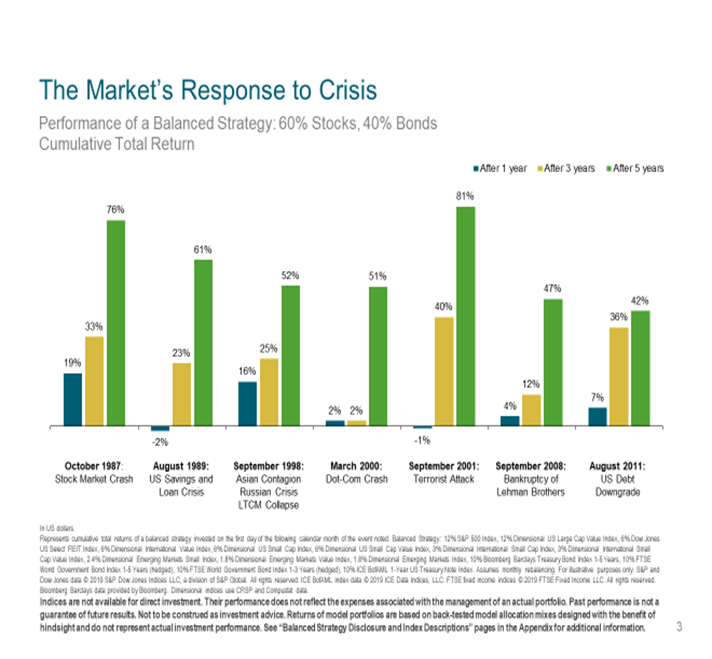

Quarterly Investing, Market and Economic Overview – Q3 2021

How's investing and what should investors know during the third fiscal quarter of 2021 and the COVID-19 pandemic. Stocks continued their upward trajectory for the quarter. The US stock market

cmpfinancial